Accounting serves as the crucial language of business‚ encompassing collection‚ recording‚ and interpretation of financial data for informed decisions;

it’s a comprehensive system.

Understanding the distinctions between financial and management accounting is vital for businesses‚ as each provides unique insights into performance and future planning.

An accounting and finance degree unlocks diverse career paths‚ shaped by current industry trends and expert instruction‚ offering a broad range of opportunities for professionals.

What is Accounting?

Accounting is fundamentally a comprehensive process – it’s the systematic way businesses collect‚ record‚ classify‚ summarize‚ interpret‚ and communicate financial information.

Often described as the “language of business‚” accounting provides a crucial framework for understanding a company’s financial health and performance. This isn’t merely bookkeeping; it’s a detailed analysis that informs strategic decisions.

The field encompasses both financial accounting‚ focused on reporting past performance to external stakeholders‚ and management accounting‚ which utilizes data to shape future strategies.

A solid grasp of accounting principles is essential for anyone involved in business‚ from entrepreneurs to investors‚ enabling informed judgments and effective resource allocation. It’s a dynamic field‚ constantly evolving with new regulations and technologies.

The Role of Accounting in Business

Accounting plays a pivotal role within an organization‚ extending beyond simply tracking finances. The administrative department relies heavily on accounting for overall management activities impacting the entire business.

Specifically‚ the accounting department meticulously maintains financial records and prepares reports – vital tools for informed decision-making. These reports aren’t just historical records; they provide insights for future planning and performance evaluation.

Understanding accounting principles is crucial for navigating the complexities of the business world‚ influencing everything from investment strategies to operational efficiency. An accounting and finance degree prepares individuals for these challenges.

Ultimately‚ accounting empowers businesses to monitor their financial health‚ comply with regulations‚ and achieve sustainable growth‚ making it an indispensable function.

Financial Accounting: Recording the Past

Financial accounting meticulously documents historical financial transactions‚ providing a clear record of past performance and a foundation for future analysis and reporting.

Core Principles of Financial Accounting

Core principles underpin financial accounting‚ ensuring consistency and reliability in reporting. The accrual basis recognizes revenues when earned and expenses when incurred‚ regardless of cash flow. Matching principle dictates aligning expenses with related revenues.

Historical cost records assets at their original purchase price‚ while the full disclosure principle demands transparency‚ revealing all relevant information. Going concern assumes the business will continue operating.

Economic entity keeps business transactions separate from personal ones. These principles‚ alongside objectivity and consistency‚ create a standardized framework. Adherence to these guidelines is crucial for producing comparable and trustworthy financial statements‚ enabling informed decisions by stakeholders.

Generally Accepted Accounting Principles (GAAP)

Generally Accepted Accounting Principles (GAAP) represent a common set of accounting rules‚ standards‚ and procedures issued by the Financial Accounting Standards Board (FASB). These principles standardize financial reporting‚ ensuring comparability across organizations.

GAAP covers areas like revenue recognition‚ balance sheet items‚ and disclosure requirements. Compliance is vital for publicly traded companies and often expected of private entities seeking external funding.

GAAP aims to provide transparency and reliability to financial statements‚ fostering trust among investors and creditors. While adherence is crucial‚ evolving standards require continuous updates and professional expertise. Understanding GAAP is fundamental for accurate financial analysis and informed investment decisions.

Financial Statements: A Comprehensive Overview

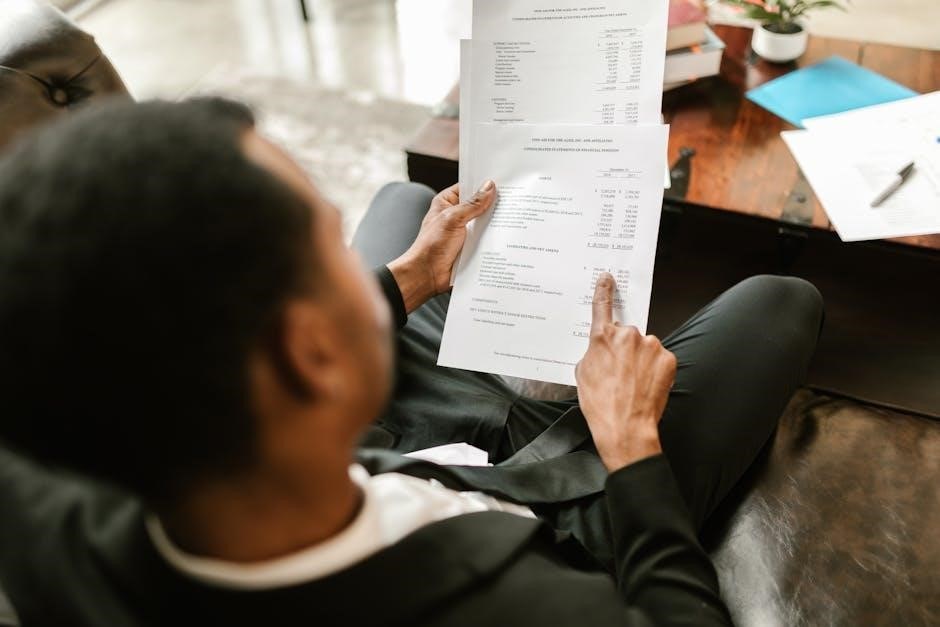

Financial statements are the formal records of a company’s financial activities‚ providing a snapshot of its performance and position. These statements are essential for stakeholders – investors‚ creditors‚ and management – to make informed decisions.

The core statements include the Balance Sheet‚ detailing assets‚ liabilities‚ and equity; the Income Statement‚ reporting revenues and expenses over a period; and the Cash Flow Statement‚ tracking cash inflows and outflows.

Analyzing these statements reveals profitability‚ solvency‚ and liquidity. Accurate and transparent reporting‚ guided by GAAP‚ is paramount. These reports are often used for external reporting and provide a historical view of the company’s financial health.

Balance Sheet: Assets‚ Liabilities‚ and Equity

The Balance Sheet presents a company’s financial position at a specific point in time‚ adhering to the fundamental accounting equation: Assets = Liabilities + Equity; Assets represent what the company owns – cash‚ accounts receivable‚ and property‚ plant‚ and equipment;

Liabilities are what the company owes to others – accounts payable‚ salaries payable‚ and loans. Equity represents the owners’ stake in the company‚ reflecting invested capital and retained earnings.

This statement provides insights into a company’s solvency and financial flexibility. Analyzing the relationship between assets‚ liabilities‚ and equity helps assess risk and potential for growth. It’s a crucial tool for investors and creditors evaluating financial health.

Income Statement: Revenues and Expenses

The Income Statement‚ also known as the Profit and Loss (P&L) statement‚ reports a company’s financial performance over a specific period. It details Revenues – the income generated from sales of goods or services – and Expenses – the costs incurred to generate that revenue.

The difference between revenues and expenses determines Net Income (profit) or Net Loss. This statement is vital for assessing a company’s profitability and operational efficiency. Analyzing revenue trends and expense control measures provides valuable insights.

Understanding the income statement is crucial for investors and management alike‚ enabling informed decisions about future investments and operational improvements. It’s a cornerstone of financial reporting.

Cash Flow Statement: Tracking Cash Movements

The Cash Flow Statement summarizes the movement of cash both into and out of a company during a specific period. Unlike the Income Statement‚ which uses accrual accounting‚ this statement focuses solely on actual cash transactions.

It’s divided into three activities: Operating (from core business activities)‚ Investing (purchase/sale of long-term assets)‚ and Financing (borrowing/repaying debt‚ issuing stock). Analyzing these flows reveals a company’s liquidity and solvency.

A positive cash flow indicates a company generates more cash than it spends‚ crucial for meeting obligations and funding growth. This statement complements the Balance Sheet and Income Statement‚ providing a complete financial picture.

Management Accounting: Shaping the Future

Management accounting empowers internal decision-making‚ utilizing financial data to optimize operations‚ control costs‚ and strategically plan for future growth and success.

Purpose of Management Accounting

Management accounting fundamentally differs from financial accounting by focusing on internal needs rather than external reporting. Its core purpose is to provide actionable insights to managers‚ enabling them to make informed decisions regarding resource allocation‚ operational efficiency‚ and strategic direction.

Unlike the historical focus of financial accounting‚ management accounting is forward-looking‚ heavily involved in budgeting and forecasting. It aids in performance measurement and analysis‚ utilizing Key Performance Indicators (KPIs) to track progress and identify areas for improvement.

The administrative department relies on the accounting department for financial records and reports‚ which are essential for effective management activities across the entire organization. Ultimately‚ management accounting aims to maximize profitability and achieve organizational goals through data-driven strategies.

Cost Accounting Methods

Cost accounting‚ a vital component of management accounting‚ focuses on determining the cost of products‚ processes‚ and activities within an organization. Two primary methods are widely employed: Job Order Costing and Process Costing.

Job Order Costing is ideal for unique or customized projects‚ tracking costs associated with each individual job. Conversely‚ Process Costing is suited for mass production of identical items‚ averaging costs across a large volume.

These methods are crucial for accurate pricing decisions‚ inventory valuation‚ and profitability analysis. Understanding these techniques allows businesses to optimize resource allocation and improve operational efficiency. The selection of the appropriate method depends heavily on the nature of the production process and the specific needs of the organization.

Job Order Costing

Job Order Costing meticulously tracks costs associated with each unique project or “job.” This method is particularly suitable for businesses offering customized products or services‚ like construction‚ printing‚ or legal services.

Costs are accumulated through direct materials‚ direct labor‚ and manufacturing overhead‚ assigned to each specific job. A job cost sheet serves as the central record‚ detailing all expenses incurred. Accurate tracking is paramount‚ often utilizing time sheets and material requisitions.

Upon job completion‚ the total cost is calculated‚ enabling businesses to determine profitability and set appropriate pricing. This detailed approach provides granular insights into the cost structure of individual projects‚ facilitating informed decision-making and resource allocation.

Process Costing

Process Costing is employed when producing large volumes of identical or similar products‚ such as chemicals‚ food processing‚ or textiles. Unlike job order costing‚ costs aren’t tracked individually for each unit.

Instead‚ total costs are accumulated for each production department or process over a specific period. These costs are then averaged across the total number of units produced‚ determining a per-unit cost. This method simplifies cost allocation in mass production environments.

Key calculations involve equivalent units of production‚ accounting for partially completed units in inventory. Process costing provides a streamlined approach to cost accounting‚ focusing on efficiency and standardization within continuous production flows.

Budgeting and Forecasting

Budgeting and Forecasting are cornerstones of proactive management accounting‚ enabling organizations to anticipate future financial performance and allocate resources effectively. Budgeting establishes a financial plan for a defined period‚ outlining expected revenues and expenditures.

Forecasting‚ conversely‚ utilizes historical data and market trends to predict future outcomes‚ informing strategic decision-making. These processes aren’t isolated; forecasts often underpin budget development‚ creating a dynamic cycle of planning and adjustment.

Effective budgeting and forecasting facilitate performance evaluation‚ identify potential risks‚ and support informed investment choices. They are vital tools for maintaining financial stability and achieving organizational goals‚ driving future success.

Performance Measurement and Analysis

Performance Measurement and Analysis are critical functions within management accounting‚ providing insights into operational efficiency and strategic effectiveness. This involves evaluating actual results against established benchmarks‚ like budgets and forecasts‚ to identify areas of strength and weakness.

Analysis extends beyond simple comparisons‚ delving into the underlying causes of variances. This often requires examining key performance indicators (KPIs) and utilizing various analytical techniques to understand trends and patterns.

The administrative department utilizes these reports to assess overall organizational health‚ while management accounting focuses on departmental and operational performance. Accurate measurement and insightful analysis are essential for continuous improvement and informed decision-making.

Key Performance Indicators (KPIs) in Management Accounting

Key Performance Indicators (KPIs) are quantifiable metrics used to evaluate the success of an organization‚ or of a specific activity‚ in achieving objectives. In management accounting‚ KPIs extend beyond traditional financial ratios to encompass operational and strategic measures.

Examples include cost per unit‚ customer satisfaction‚ market share‚ and employee turnover. These indicators provide a focused view of performance‚ enabling managers to identify areas needing attention and track progress over time.

Effective KPI selection aligns with strategic goals‚ ensuring that measurement efforts drive desired outcomes. Analysis of KPIs‚ combined with variance analysis‚ informs decision-making and supports continuous improvement initiatives within the business.

Financial vs; Management Accounting: A Detailed Comparison

Financial accounting focuses on historical reporting for external users‚ while management accounting aids internal decision-making with forward-looking insights and analysis.

Differences in Users of Information

Financial accounting primarily serves external users such as investors‚ creditors‚ regulators‚ and the public. These stakeholders require standardized‚ reliable financial statements to assess an organization’s performance and financial position. The information provided must adhere to Generally Accepted Accounting Principles (GAAP)‚ ensuring consistency and comparability across different companies.

Conversely‚ management accounting caters to internal users – managers at all organizational levels. They utilize accounting data for planning‚ controlling‚ and decision-making. This information is often customized to specific needs and isn’t bound by GAAP. The focus is on providing relevant‚ timely data to improve operational efficiency and achieve strategic goals. Internal reports can include budgets‚ performance analyses‚ and cost assessments‚ tailored for internal consumption and not public disclosure.

Differences in Reporting Frequency

Financial accounting reports are typically produced on a periodic basis‚ commonly quarterly and annually. This structured schedule aligns with the needs of external stakeholders who require regular updates on a company’s financial health. These reports – the balance sheet‚ income statement‚ and cash flow statement – are subject to audit and public disclosure‚ demanding a rigorous and consistent timeline.

Management accounting‚ however‚ operates on a much more flexible schedule. Reports are generated as needed to support managerial decisions. This could be daily‚ weekly‚ monthly‚ or even ad-hoc‚ depending on the specific information requirements. The emphasis is on timeliness and relevance‚ prioritizing immediate insights over strict adherence to a predetermined reporting cycle. This allows for proactive adjustments and informed responses to changing business conditions.

Differences in Regulations and Standards

Financial accounting is heavily governed by external regulations and standards‚ most notably Generally Accepted Accounting Principles (GAAP). These principles ensure consistency‚ comparability‚ and transparency in financial reporting‚ crucial for investors and creditors. Compliance with GAAP is often legally mandated‚ and reports undergo independent audits to verify accuracy and adherence to these standards.

Management accounting‚ conversely‚ operates with significantly less regulatory oversight. While ethical considerations are paramount‚ there’s no requirement to adhere to GAAP or undergo external audits. The focus is on providing relevant and reliable information for internal use‚ allowing organizations to tailor their accounting practices to their specific needs and objectives. This flexibility enables customized reporting formats and metrics aligned with strategic goals.

PDF Resources for Financial and Management Accounting

Numerous PDF resources‚ including online textbooks and guides‚ are available from professional organizations like AICPA and CIMA‚ aiding learning and professional development.

Free Online Textbooks and Guides

Accessing free online resources is an excellent starting point for students and professionals seeking to deepen their understanding of financial and management accounting principles. Several websites offer comprehensive textbooks and guides in PDF format‚ covering foundational concepts to advanced techniques.

OpenStax provides a free‚ peer-reviewed financial accounting textbook‚ suitable for introductory courses. AccountingTools offers a wealth of articles‚ guides‚ and templates‚ many available for download as PDFs‚ focusing on practical application. Furthermore‚ various university websites publish lecture notes and course materials that can be freely accessed.

These resources often include detailed explanations‚ illustrative examples‚ and practice questions‚ enabling self-paced learning and skill development. While the quality can vary‚ these free materials provide a valuable supplement to formal education and professional training‚ making accounting knowledge more accessible to a wider audience.

Professional Organization Publications (e.g.‚ AICPA‚ CIMA)

Professional accounting bodies like the AICPA (American Institute of Certified Public Accountants) and CIMA (Chartered Institute of Management Accountants) are invaluable sources of authoritative guidance and resources. They publish a wide range of materials‚ including white papers‚ research reports‚ and practice aids‚ often available as downloadable PDFs.

AICPA offers resources on US GAAP and auditing standards‚ while CIMA focuses on management accounting principles and practices. These publications frequently delve into emerging trends‚ best practices‚ and ethical considerations within the profession.

Access to these resources often requires membership‚ but many organizations offer free introductory materials or public access to select publications. Utilizing these professional resources ensures you’re learning from industry leaders and staying current with the latest developments in financial and management accounting.